Fund description

ERSTE STOCK EUROPE EMERGING invests primarily in companies domiciled in or with business interests in Central, Southern and Eastern European countries (incl. CIS, successor states of the Soviet Union and Turkey). The fund's investment process is based on fundamental company analysis. The selection of securities is based on high-quality and high-growth companies. Hedging of foreign currency risks is generally not planned, but possible.

The fund pursues an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark index (for licensing reasons, the specific name of the index used is given in the prospectus, item 12 or KID "Objectives and investment policy"). The composition and performance of the fund may deviate substantially to completely, positively or negatively from that of the benchmark index over the short and long term. The discretion of the management company is not limited.

Suspension of price calculation as of 24.02.2022

Due to the current political situation and the resulting uncertainties regarding the fungibility of the Moscow Stock Exchange, the price calculation and the unit certificate business have been suspended for ERSTE STOCK EUROPE EMERGING as of February 24th, 2022. The resumption of the unit certificate business will be announced separately.

For more information: Suspension of price calculation: ERSTE STOCK RUSSIA, ERSTE STOCK EUROPE EMERGING, Global Flexible Strategy Fund 2 (erste-am.at)

Current developments

With the beginning of the Ukraine crisis, there were significant sanctions against Russian companies, restrictions on the tradability of Russian securities, the exclusion of some Russian banks from the international payment system SWIFT, the closure of the Moscow Stock Exchange and a drastic devaluation of the Russian ruble.

On March 9th, 2022, international index provider MSCI Inc. classified the Russian stock index MSCI Russia from Emerging Market to Standalone. As a result, all Russian stocks were removed from international indices (for more information, click here).

However, the indices of other Eastern European countries have also suffered from the current geopolitical situation.

On the one hand, there are fears that the conflict will spread to these countries as well. On the other hand, these countries are importers of raw materials. As a result, the sometimes-extreme rise in commodity prices has led to a shock. This exacerbates the problem of high inflation rates that already existed before.

The following chart shows the development of the stock markets in Poland, Turkey and Hungary. It is easy to see here how the start of the war in Ukraine led to losses in these Eastern European stocks. In the meantime, some of the losses have been recovered.

Source: Reuters Datastream, data as of 18.03.2022

Past performance is not a sufficient indicator of the future performance of the fund. Due to the very short term, this presentation of the performance is not very representative.

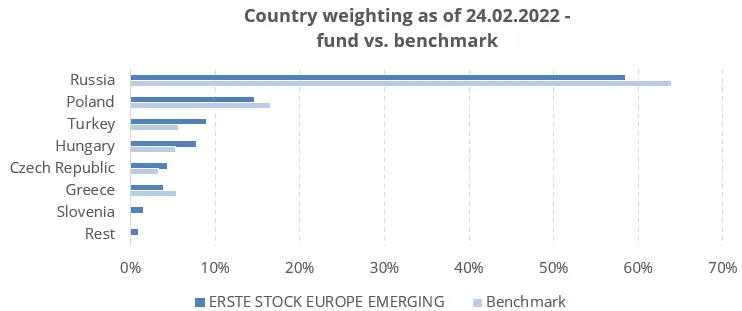

Source: EAM, data as of 24.02.2022

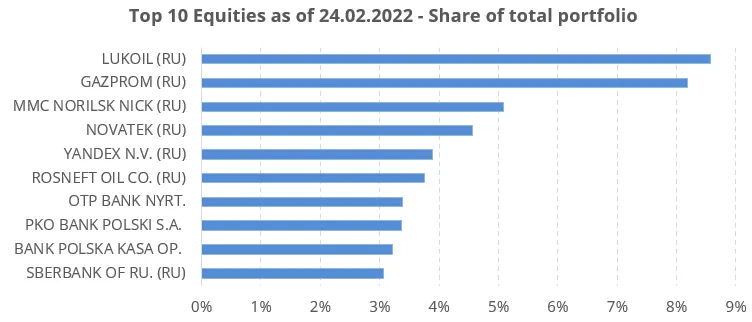

Of the 58 shares in the portfolio, a total of 21 shares were from Russia. Among the top 10 positions were 7 stocks from Russia (see chart below - stocks with (RU)).

Source: EAM, data as of 24.02.2022

The companies listed here have been selected as examples and do not represent an investment recommendation. They are examples from the portfolio. There is no claim that the securities will be permanently included in the portfolio.

Ukrainian equities were not in the portfolio.

Outlook

As the Russian stock exchange remains closed until further notice, there is no information regarding an opening date and the tradability of the Russian securities is very limited, the unit certificate business of ERSTE STOCK EUROPE EMERGING remains suspended as pricing is currently not possible. The situation is monitored on a daily basis, but due to the current political situation it is not possible to predict when pricing and unit certificate business can be resumed. We will provide information on any changes in a timely manner.

The future development of the entire portfolio will continue to be largely determined by the current geopolitical situation. A further escalation could once again lead to price losses. A de-escalation could contribute to a further recovery of Eastern European equities.

Cost reduction

Against the backdrop of the escalating conflict between Russia and Ukraine, trading conditions on local markets are currently not as they would normally function.

Following the suspension of the issuance, the redemption of shares and the publication of a NAV, Erste Asset Management GmbH has decided to change the management fee as follows.

The reduction of the management fee is valid until further notice and retroactively as of March 1st, 2022.

Disclaimer

This document is an advertisement. Please refer to the prospectus of the UCITS or to the Information for Investors pursuant to Art 21 AIFMG of the alternative investment fund and the Key Information Document before making any final investment decisions. Unless indicated otherwise, source: Erste Asset Management GmbH. Our languages of communication are German and English.

The prospectus for UCITS (including any amendments) is published in accordance with the provisions of the InvFG 2011 in the currently amended version. Information for Investors pursuant to Art 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in connection with the InvFG 2011. The fund prospectus, Information for Investors pursuant to Art 21 AIFMG, and the Key Information Document can be viewed in their latest versions at the web site www.erste-am.com within the section mandatory publications or obtained in their latest versions free of charge from the domicile of the management company and the domicile of the custodian bank. The exact date of the most recent publication of the fund prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the Key Information Document are available, and any additional locations where the documents can be obtained can be viewed on the web site www.erste-am.com. A summary of investor rights is available in German and English on the website www.erste-am.com/investor-rights as well as at the domicile of the management company.

The management company can decide to revoke the arrangements it has made for the distribution of unit certificates abroad, taking into account the regulatory requirements.

Detailed information on the risks potentially associated with the investment can be found in the fund prospectus or Information for investors pursuant to Art 21 AIFMG of the respective fund. If the fund currency is a currency other than the investor's home currency, changes in the corresponding exchange rate may have a positive or negative impact on the value of his investment and the amount of the costs incurred in the fund - converted into his home currency.

Our analyses and conclusions are general in nature and do not take into account the individual needs of our investors in terms of earnings, taxation, and risk appetite. Past performance is not a reliable indicator of the future performance of a fund.