The ERSTE BOND DANUBIA fund invests mainly in government bonds from the Central and East European region (CEE), the former Soviet states, and Turkey. The portfolio contains issues in hard currency (EUR, USD, EUR-hedged) in addition to bonds denominated in local currency. Depending on the market environment, local currencies are temporarily hedged against the euro. Environmental, social, and governance factors are integrated in the investment process. The fund follows an active investment strategy and has no benchmark. The assets are selected on the basis of a discretionary process, and the margin of discretion available to the asset management company is not limited.

Pricing 1 March 2022 to 16 March 2022

Due to the political situation and the resulting uncertainties with regard to the trading of Russian securities contained by the fund and the sanctions imposed against Russia, we suspended the pricing of, and trading in, shares of ERSTE BOND DANUBIA from 1 March 2022.

Suspension of price calculation: ERSTE BOND DANUBIA (erste-am.at)

Pricing and trading were resumed on 16 March 2022.

Development between the suspension of pricing and resumed pricing

The depositary bank establishes the net asset value of the investment fund on the basis of the prices of the securities, money market instruments, subscription rights, financial investments, cash, credit balances, receivables and other rights, minus liabilities.

As of 28 February, Russian government bonds accounted for about 9% of assets of the fund.

Given the political situation, the rating agencies downgraded Russian government bonds from investment grade to “highly speculative” (i.e. at risk of default).

Also, due to the capital market sanctions imposed by the EU, the affected securities can currently not be traded.

As of 16 March 2022, the Russian government bonds in the investment fund are valued at 4.5% given the current market scenario. As a result of sales and the fall in prices, the weighting of Russia in the fund has declined to a low single-digit value.

This downgrade relative to the prices prior to the suspended pricing has caused a drastic decrease in the calculatory value of ERSTE BOND DANUBIA. We are evaluating the situation on an ongoing basis and re-value these positions if need be. Any re-valuation affects the calculatory value of the fund.

Portfolio performance

The majority of ERSTE BOND DANUBIA consists of government bonds from other European states in local currency and hard currency (EUR, USD, EUR-hedged). The bonds of these countries have also taken a hit from the current geopolitical situation.

There is the concern that the conflict may spill over into these countries, which are also commodity importers. As a result, the, in some cases, extreme increase in commodity prices has caused a negative shock. This has exacerbated the already dire situation of high inflation rates.

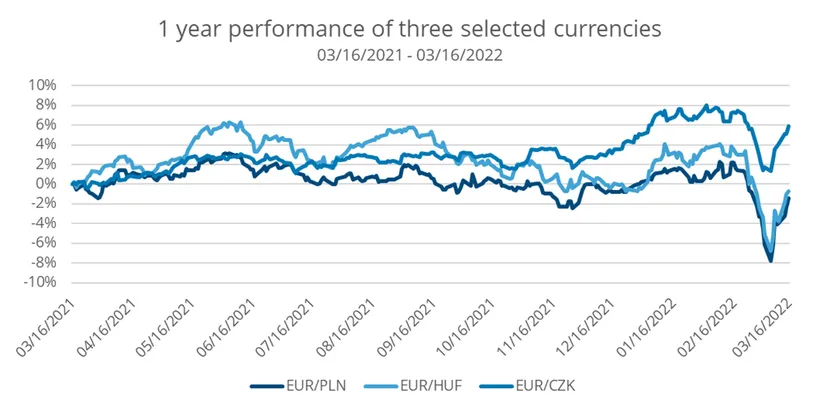

The following chart shows the performance of three East European currencies. It illustrates how the beginning of the war in Ukraine has caused the East European currencies to depreciate relative to the euro. The losses have been partially recovered in the meantime.

Source: Bloomberg

Past performance is not a sufficient indicator of the future performance of the fund.

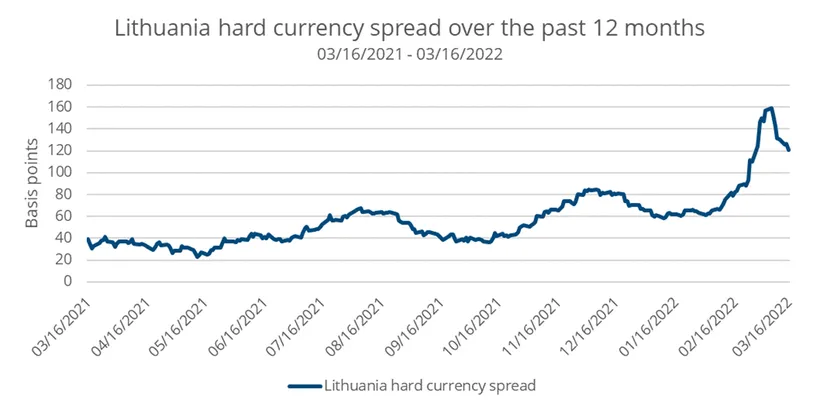

The spreads* of East European government bonds are painting a similar picture, having widened significantly since the beginning of the war. This has led East European government bonds to incur losses. In recent days, the spreads have narrowed again slightly, but they remain far from their original levels.

As an example, we have chosen the spreads of Lithuanian bonds in hard currency.

Source: Bloomberg

Past performance is not a sufficient indicator of the future performance of the fund.

The future development of the entire portfolio therefore remains crucially determined by the ongoing geopolitical situation. Another escalation could trigger another wave of losses, whereas de-escalation could contribute to a further recovery of East European government bonds.

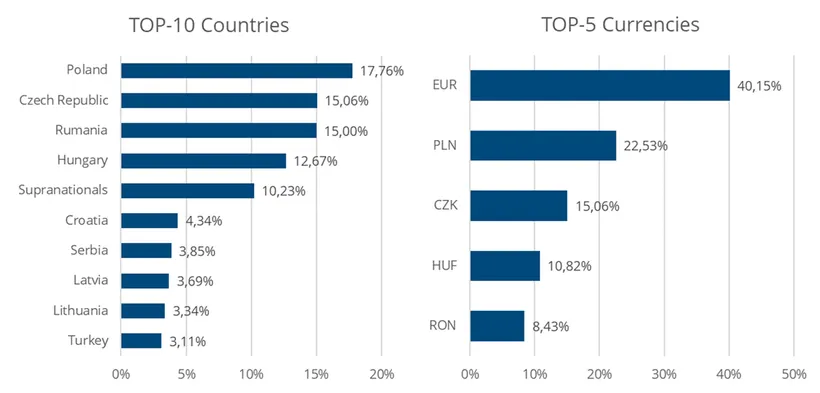

In the following, the breakdown by country of ERSTE BOND DANUBIA as of 16 March 2022.

Source: Erste Asset Management.

Prognoses are not a reliable indicator of future performance.

10Y chart:

* Spread: interest rate differential between the bond in question and safe government bonds, such as German government bonds or US Treasuries.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

Disclaimer

This document is an advertisement. Please refer to the prospectus of the UCITS or to the Information for Investors pursuant to Art 21 AIFMG of the alternative investment fund and the Key Information Document before making any final investment decisions. Unless indicated otherwise, source: Erste Asset Management GmbH. Our languages of communication are German and English.

The prospectus for UCITS (including any amendments) is published in accordance with the provisions of the InvFG 2011 in the currently amended version. Information for Investors pursuant to Art 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in connection with the InvFG 2011. The fund prospectus, Information for Investors pursuant to Art 21 AIFMG, and the Key Information Document can be viewed in their latest versions at the web site www.erste-am.com within the section mandatory publications or obtained in their latest versions free of charge from the domicile of the management company and the domicile of the custodian bank. The exact date of the most recent publication of the fund prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the Key Information Document are available, and any additional locations where the documents can be obtained can be viewed on the web site www.erste-am.com. A summary of investor rights is available in German and English on the website www.erste-am.com/investor-rights as well as at the domicile of the management company.

The management company can decide to revoke the arrangements it has made for the distribution of unit certificates abroad, taking into account the regulatory requirements.

Detailed information on the risks potentially associated with the investment can be found in the fund prospectus or Information for investors pursuant to Art 21 AIFMG of the respective fund. If the fund currency is a currency other than the investor's home currency, changes in the corresponding exchange rate may have a positive or negative impact on the value of his investment and the amount of the costs incurred in the fund - converted into his home currency.

Our analyses and conclusions are general in nature and do not take into account the individual needs of our investors in terms of earnings, taxation, and risk appetite. Past performance is not a reliable indicator of the future performance of a fund.